Remove the busy work. Make space for growth.

Stora is the self storage software that automates admin so you can focus on growing your business.

Trusted by fast-growing, forward-thinking self storage businesses worldwide.

Running a self storage

business is hard work.

You’re constantly following up phone and website enquiries - meaning sales close slower and other opportunities can be missed.

Without the right tools in place, staff are required on site to check customers in and facilitate their access.

When payments are missed, you’re stuck chasing them and manually overlocking storage units, wasting time and losing revenue.

There’s a better way...

Stora provides automation where you need it, and control where you want it.

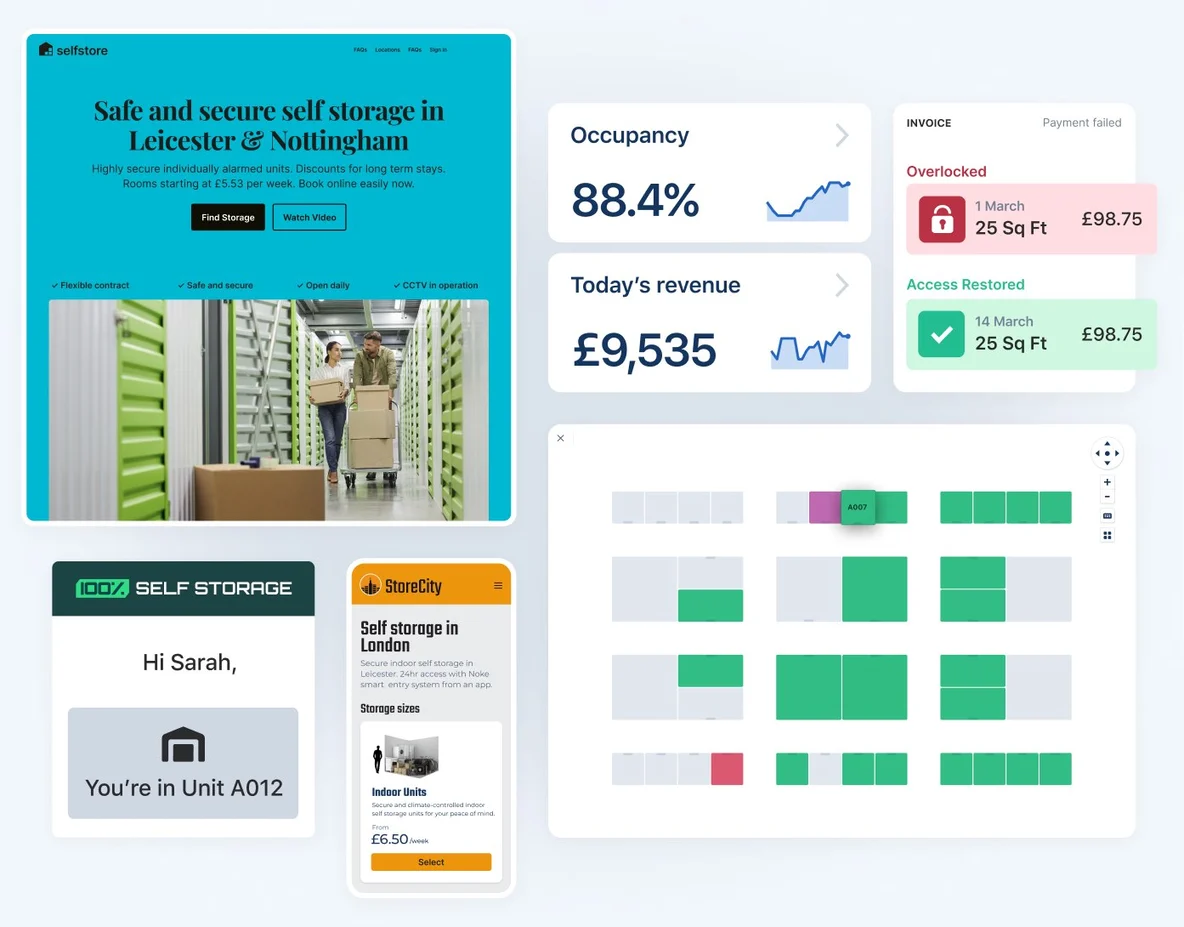

Take bookings & payments through your website, automate access, and manage your business from a single app, on any device.

Why modern self storage operators use Stora

Take online bookings and payments

Get a fully integrated booking system designed for today’s self storage manager. Enable both staffed and unstaffed facilities to take bookings and recurring payments online.

- Customers can book and pay for storage in a few clicks.

- Offer your customers flexible payment methods.

- Automate generating, sending, and filing invoices.

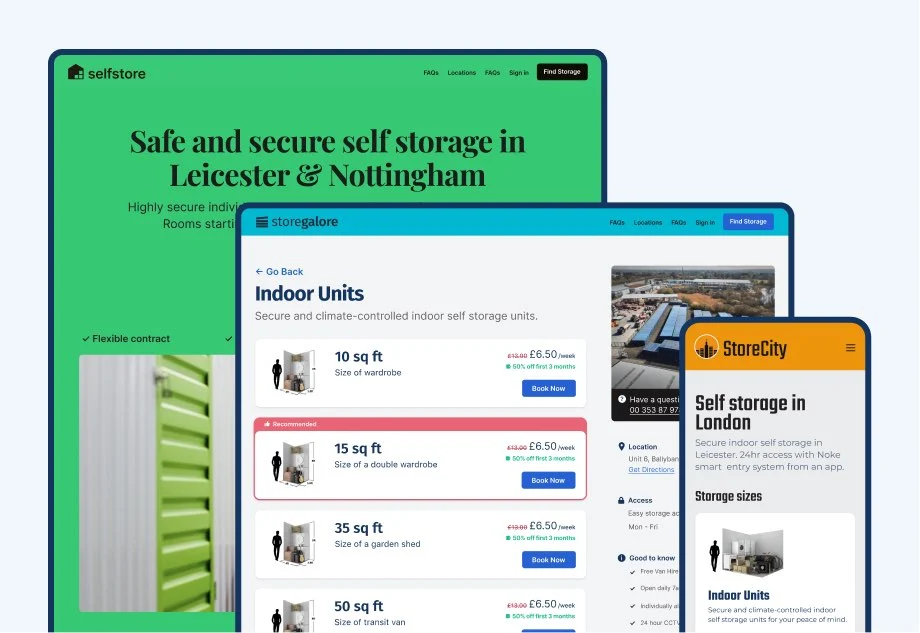

Fully optimised websites

With Stora, you get a conversion and search engine optimized website that makes bookings easy for operators and storage tenants alike. (Already have a website? Stora will seamlessly integrate with it.)

- Built-in forms that fill your sales funnel.

- Fast-loading sites with 99.5% uptime.

- Free storage unit and marketing photos.

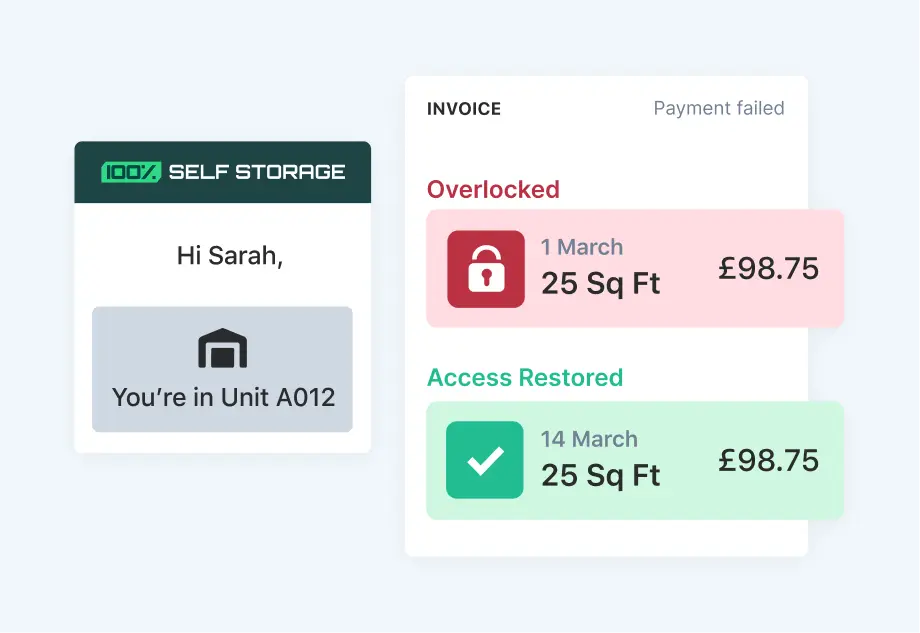

Auto-access and overlocking enabled

Provide effortless access for your customers and stop tenant troubles before they start with auto-overlocking when payments fail.

- Automate unit reservation and the sending of move-in instructions.

- Connect your smart entry system so customers can access their units automatically.

- Lock tenants out when payments are late.

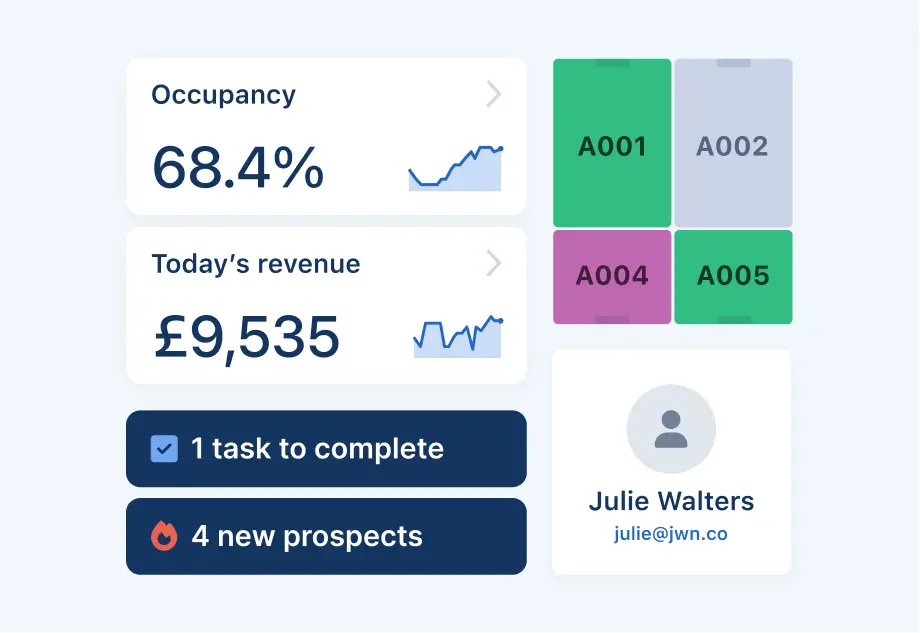

Manage your facility with ease

Use our suite of facility management tools to quickly view unit availability, manage unit status, and track key business metrics with real-time data.

- Your Storefront is set up to match your availability in real time.

- Automatically make units available after a customer leaves.

- See real-time vacancies in one place with smart maps.

For operators,

by operators.

Our founder and CEO originally created Stora to improve the efficiency of his self storage business operations. Now, we're trusted by hundreds of storage owners worldwide.

It’s easy to switch.

Using another self storage software already? We know that switching can be daunting, that’s why our team is with you every step of the way.

Michael Walker, Standby Self Storage"We switched many sites and just short of 1,000 customers all with existing payment details and smart entry codes to Stora. Their team did a lot of the heavy lifting and supported us throughout the entire process.

It went incredibly smoothly, all invoices and payments came across without any problems, and all smart entry codes were imported across perfectly."

Self storage

operators love Stora

"Simpler yet more effective than competitors, Stora definitely has an eye on the future. Best decision I've made."

“We wanted an automated facility with no on-site staff. We expected it to take months and cost a fortune. With Stora it took minutes all for a low price that scales with our sales.”

Stora is game changing.

“I'll be full in 2 months if it keeps on like this. 22,000 sq ft in 10 months, I'd planned for 3 years. Wouldn't have been the case without Stora.”

“The map is awesome!”

“Less time wasted, more time for other work.”

“I manage my site from my phone with no issues.”

“I'll be full in 2 months if it keeps on like this. 22,000 sq ft in 10 months, I'd planned for 3 years. Wouldn't have been the case without Stora.”

“Exactly what we needed!”

“Integrates seamlessly with other core systems.”

“I am really liking some of the new features.”

“The help and support is second to none.”

“The onboarding with Stora was flawless.”

Frequently asked questions (FAQs)

-

What is self storage software?

-

Operators use self storage management software to seamlessly manage and automate their storage facilities. It streamlines business operations, including taking bookings online, capturing leads, and automatically managing pricing based on occupancy rules.

-

How do you automate self storage facilities?

-

With Stora, you can automate your entire self storage facility, including:

- Taking bookings online

- Capturing leads

- Your pricing

- Recurring payments

- Invoicing

- Facility access

- Move-ins (and move-outs)

-

Is owning a self storage business profitable?

-

Running a self storage facility is highly profitable, especially if you automate your operations. Self storage businesses can be made even more profitable when you use the right software that helps you manage your facility and provide your customers with an excellent experience.

Grow with Stora today

Join modern self storage businesses worldwide who grow sales, reduce costs and save time with Stora.