We are living in increasingly busy times. Busy working, busy parenting, busy fixing up our homes, and everything in between. So, finding ways to minimize repetitive, time-consuming tasks is key to building a life with more quality time to do the things we love.

We know that when you’re running a business, accounting is one of the most time-consuming things and it comes around all too often. So, how does doing your monthly accounting in under 30 minutes sound?

In this article, we give you a detailed step by step guide to quick and easy accounting with Stora.

With Stora, you can now follow the process below to accurately complete your self storage business accounting each month. It’s quick and most importantly, it’s easy.

Some points before we dive in

- Disclaimer: Getting set up and doing this for the first time will take 1-2 hours and some accounting support. However, from then on, it should take less than 30 minutes per month.

- We would recommend getting the help of an accountant to get this set up, and perhaps have them carry it out the first and subsequent times until you are comfortable with the output.

- This process is compatible with Xero, Quickbooks, and all major accounting software products.

What we’ll cover

This is a 4 step process based on the creation of journal entries to post into your accounting system. The steps cover:

- Revenue figures

- Reconciliation of Stripe payouts versus bank account (Stora-automated payments)

- Aged Debtors

- Reconciliation of manual payments versus bank account

FREE Accounting Template

In order to carry out the process detailed in this article you will also require this spreadsheet. Do not try and edit this sheet, instead create your own copy by clicking on File along the top of the screen, then click ‘Make a copy’.

What you’ll need

Requirements

- You must be signed up for Stripe Revenue Recognition. There is a small charge for this, levied by Stripe. Set this up in Stripe here.

- In your accounting system, you will need to set up the required accounts. See list in column G in Journal 1 tab in the spreadsheet and enter these into your accounting system. Enter the correct accounting system account codes in column G in the Journal 1 sheet.

- One of the accounts in column G in Journal 1 is the Stripe debtor control account. When setting this up, ensure to set an opening balance that equates to the balance owed to you by Stripe at that point. This can be calculated as follows: (Stripe receipts - Stripe payouts, refunds and fees). See Stripe - Reports - Financial Reports for this data.

- Please seek your own professional accounting advice. Stora and its advisors do not take any responsibility for accounting and the below is offered as guidance only.

Step 1: Revenue Figures

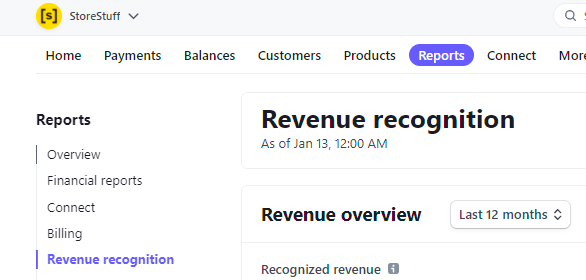

Go to your Stripe account, click on Reports and go to Revenue Recognition

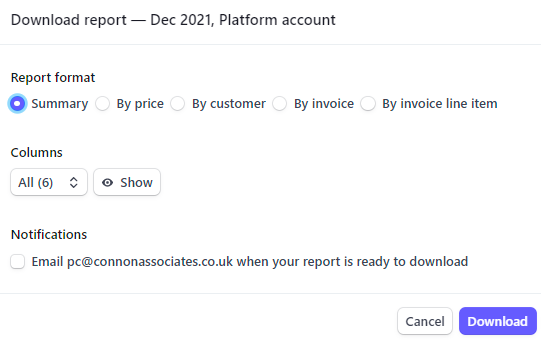

Scroll down to Reports and Statements, and download the Debits and Credits report. Select the period of the report (usually a calendar month).

Tick summary and click on download

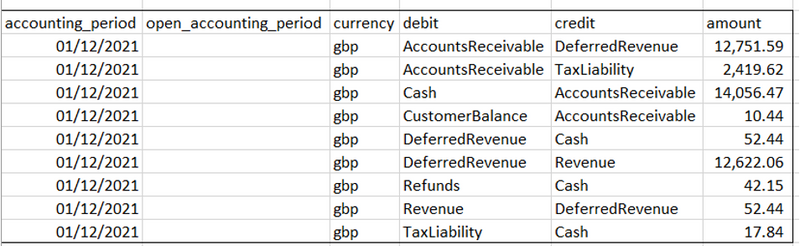

This will generate a csv file similar to this:

- Copy the data in the csv file and enter it into the J1 input tab in the spreadsheet linked above. Enter it in the yellow section where indicated.

- Ensure cell G4 in tav J1 recon is nil - if not please investigate and do not post the journal until this is nil. This ensures the numbers reconcile between the journal and the Stripe debtor.

- Depending on your accounts system and whether you have any income not subject to standard-rates tax/VAT you may need to post the Revenue and Tax Liability lines differently - see rows 31 and 32 of Journal 1 tab for alternative posting. A separate calculation of exempt income should be carried out at the tax year end where exempt income may breach the partial tax exemptions. Please seek professional advice.

- Amend the sales tax rate in Journal 1 tab to be the correct rate (default is 20%).

- Post the data in Journal 1 from the data in the blue cells as indicated.

Step 2: Reconciliation of Stripe payouts

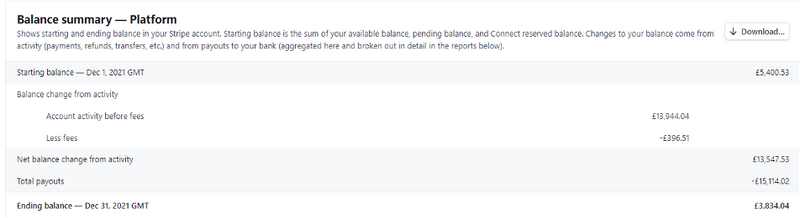

- In Stripe, go to Reports > Financial Reports

- Select the appropriate date range (usually a calendar month)

- Take the figures for Fees from the top half of the report - £396.51 in the report below - and add to Journal 2 tab in the yellow cell where highlighted. This will generate Journal 2 in the blue cells in the Journal 2 tab.

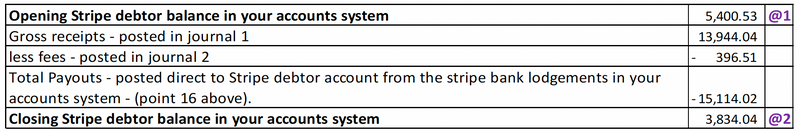

- In your accounting system, post all bank lodgements received from Stripe in the period to the Stripe Debtor control account with your accounts system. The total of these in the period should equate to the Total Payouts figure in the Balance summary - Platform report (tab J1 recon). This is £15,114.02 in the example.

- The ending balance in the ‘Balance Summary - Platform’ report (from Stripe) which is £3,834.04 in the example image in tab J1 recon, should equate to the Stripe debtor balance in your accounts system. If it does not, please investigate.

In the image above we have added a couple of notes:

Note @1: As mentioned during the setup phase outlined above, the first time you start using this procedure you will have to enter the Opening Stripe Debtor balance as an initial journal and the entry will depende on how Stripe transactions have been accounted for previously. Please ask for advice.

Note @2: This closing stripe debtor balance should agree to your Stripe Debtor balance at month-end in your accounts system after journals 1 and 2 have been posted and all Stripe lodgements to you bank account have been posted. Any differences should be investigated.

Step 3: Aged Debtors

You can run a report to list the balances making up the aged debtors total in your accounts. This is the debtors total (movements are posted as part of the Journal 1 tab which is £1,104.30 in the example).

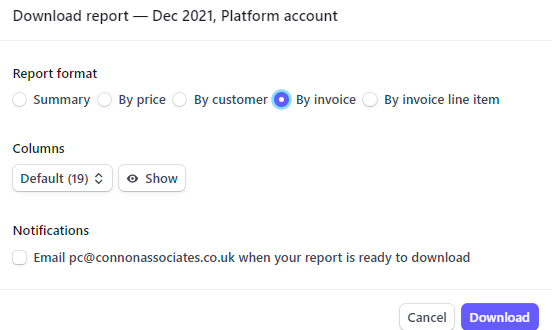

- Go to Stripe > Reports > Revenue Recognition and Select the appropriate date range (usually a calendar month)

- Select Accounts Receivable aging and click on Download

- Select “By Invoice” and click download to generate a csv file

The sum of all the “amount…” columns should equal the Accounts Receivable (manual a/c) balance in your accounts as these movements are all posted via Journal 1.

Note that you may have to enter the balance into this account upon first using the approach in these instructions. This will depend upon how you have entered Stripe transactions previously into your accounts system. Please ask for advice.

Step 4: Manual Payments (bank transfers, cheque, etc)

This is where the invoice is created by Stora but the customer pays outside of Stora, by bank transfer, check, cash, etc. These receipts should all be deposited into your bank account and therefore come through as a bank deposit in your accounting system.

- When a payment has been made against an invoice, whether by spotting the funds landing in the bank account, seeing the check clear, or by receiving the cash, go into your Stora account and mark the relevant invoice as paid.

- This will then add the amount to Stripe’s External Asset journal. In Journal 1 above, these ‘external asset entries’ are coded to a “Manual Payments Debtor control” which you may have to set up in your accounting system.

- Open your accounting system, and reconcile all bank transactions / lodgements in your accounting system relating to manual payment invoices against this Manual Payments Debtor control account.

- These Lodgements / refunds paid should equate to the External Asset posting from Journal 1 and the closing balance in the manual payments debtor control account should be nil at month-end. Any balances should be investigated and corrected - differences could arise due to receipts / refunds posted in error into Stripe; non-manual payment invoice lodgements /refunds in XERO bank misposted to the control account or manual payment invoice lodgements /refunds in XERO bank not posted to the control account.

What is coming in future?

Our goal at Stora is to automate this entire process in future. There are a variety of ways we could achieve that, and we will be carrying out early investigations in the the coming months.

In the meantime, if you have any comments, questions, or issues with any of the above please get in touch.

Want to know more about Stora?

Stora helps the next generation of self storage businesses market and sell their services online. Learn more about how it works or schedule a demo today.