Philip Macauley, head of self storage UK at global real estate firm Cushman and Wakefield, reveals exciting opportunities for new operators and investors.

Following the release of the 2021 Self Storage Association Report (SSA), produced in conjunction with Cushman & Wakefield, we can confirm that the self storage sector has not only been robust during the pandemic, but has shown significant growth.

Since the first publication of the SSA report in 2004, we have witnessed record highs in both store occupancy and rental rates (UK national average). For the first time, average occupancy is over 80% (82.3%) and rental rates close to £24psf (£23.94psf).

“For the first time, average occupancy is over 80%”

So what has driven the market over the last 12 months? A large part of the growth can be attributed to the following factors:

• An increase in SME online retailers requiring additional storage space

• Change in our working environment

• Stamp duty payment holidays

• (Sadly) An increase in the death rate

• Divorce rates are at a 50 year high (ONS)

“Rental rates close to £24 per square foot”

Here To Stay

Will we see these gains fall away in the short to medium term? Here at C&W, we don’t think so. A number of the pandemic drivers will remain:

Residential

The residential market has long been a mainstay of the self storage sector and will continue to do so going forward.

Employment

A significant number of employers have signalled their willingness to allow more flexible working arrangements. Therefore, cleared space in the home will be desirable for many employees in the future.

Internet

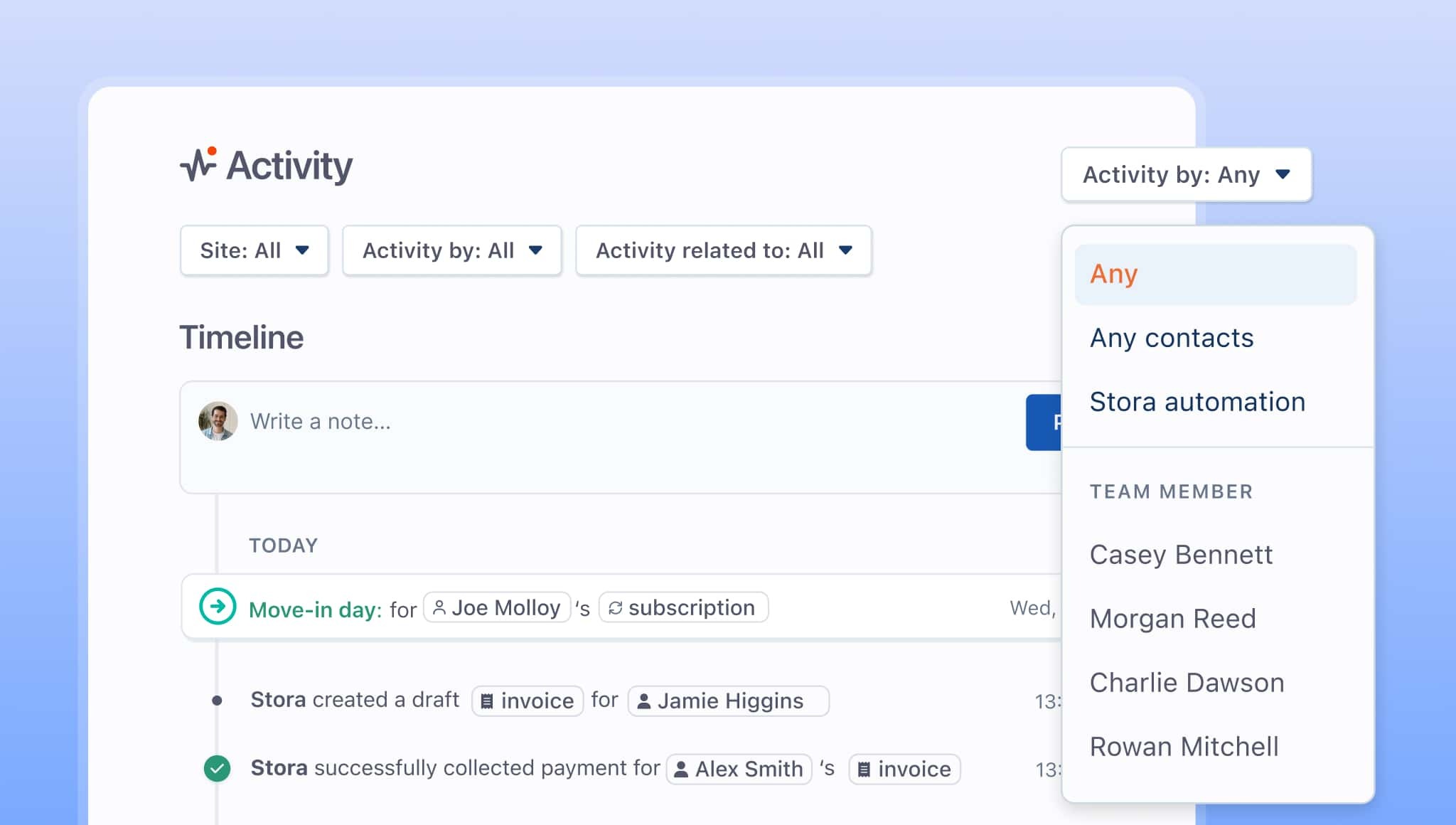

Customer shopping habits have changed during the pandemic, with more consumers shopping online. Convenience and flexibility are key now, with the customer expecting to have questions answered and needs met quickly online.

As a result, there are significant gains to be had in the self storage sector—both as an operator and investor.

Philip Macauley, Partner, Valuation & Advisory

Tel: +44 (0) 7584 857 149

Email: philip.macauley@cushwake.com

Investor perspective

There is a growing interest in the sector from ‘new money’. We are seeing an increase in the number of institutional investors looking to take advantage of the market, but also diversify their portfolio away from struggling sectors such as retail and leisure.

Private equity money is attempting to enter the sector, both in the UK and in Europe. This is in addition to operators looking to expand their platform via acquisition and developers seeking to provide opportunities to what is currently an under-supplied market.

As a consequence, we have seen a noticeable sharpening in pricing over the last 12 months.

So far this year we have seen over 10 transactions (over 20 since January 2020), so it’s an exciting time for an industry finally coming into its own.

What are you waiting for?

Are you a startup in early stages of setting up your self storage business? Perhaps you’d like to learn why you need to launch your self storage website before opening…

Want to know more about Stora?

Stora helps the next generation of self storage businesses sell online. Learn more about how it works or schedule a demo today.