Self storage is unusual as a business model. You are responsible for providing a secure space for other people’s property, but you do not automatically insure the items they store.

With more than 11% of U.S. households renting a storage unit, that misunderstanding affects millions of tenants and operators alike.

In practice, both sides of the relationship are often unclear about where responsibility starts and ends.

Operator insurance typically protects the facility and its liability, not its tenants' belongings. As a result, issues often surface after a loss or dispute.

This guide explains who is responsible for what, then covers the available self storage insurance options and how to efficiently ensure your customers have the right coverage.

What Is Self Storage Insurance? Responsibilities Explained

Self storage insurance is often misunderstood because it refers to two separate forms of cover that protect different parties.

When people talk about self storage insurance, they are usually referring to one of the following:

- Operator insurance covers the storage facility, business operations, and certain liabilities.

- Tenant insurance covers the personal or business property stored inside a unit.

These are distinct policies with different policyholders, responsibilities, and claims processes.

What you are responsible for as a self storage operator

In practice, a self storage operator is responsible for:

- Maintaining the buildings and fixed infrastructure (units, gates, fencing, lighting, offices)

- Keeping common areas reasonably safe for tenants and visitors

- Providing and maintaining the security measures you advertise

- Following the legal process when restricting access, auctioning, or disposing of unit contents for non-payment

Therefore, operators should have storage unit insurance policies that cover these responsibilities.

You are not generally responsible for insuring tenant belongings, and you do not usually need to guarantee protection against theft, fire, water damage, or other losses inside a unit.

The only exception is if negligence can be proven. For example, if you advertise or provide access controls, gates, or lighting, then you may be found liable for loss if it was caused because those systems weren’t properly maintained.

What tenants are responsible for

Tenants are responsible for what they store.

From an insurance perspective, this typically involves:

- Insuring their stored goods, either through their own policy or a facility-offered option

- Understanding coverage limits, particularly for items stored off-premises

- Declaring high-value or restricted items, which may require additional cover

- Complying with lease terms and facility rules, including prohibited items and access policies

Why disputes occur and how to avoid them

Most disputes occur after a loss, when a tenant assumes their belongings were covered and discovers they were not.

If you set clear insurance expectations early, then you reduce disputes, limit liability exposure, and give tenants a clear path to recovery if something goes wrong. Many facilities now require or strongly encourage tenant insurance for these reasons.

Is Insurance Mandatory for Self Storage Providers?

Self storage providers are rarely legally required to have insurance. However, in practice, most operators must carry it to operate commercially.

In the U.S., UK and Australia, self storage businesses are generally regulated through a mix of property, contract, and consumer laws rather than a dedicated licensing framework that mandates insurance.

That said, the absence of a blanket legal requirement does not mean insurance is optional in practice.

When insurance becomes effectively mandatory

For most operators, insurance is required through contractual obligations, including:

- Lender requirements: Property and liability insurance are almost always conditions of financing.

- Landlord requirements: If you lease the site, insurance is typically mandated in the lease agreement.

- Investor expectations: Investors usually require defined insurance cover to protect their capital and limit risk exposure.

In these cases, insurance is functionally mandatory even if it is not imposed by law.

Why general liability is critical

Regardless of legal requirements, facilities that allow public access face unavoidable exposure to injury and third-party claims.

Operating a self storage facility without general liability insurance is rarely viable and exposes the business to significant financial risk.

As a result, general liability insurance is considered essential rather than optional coverage.

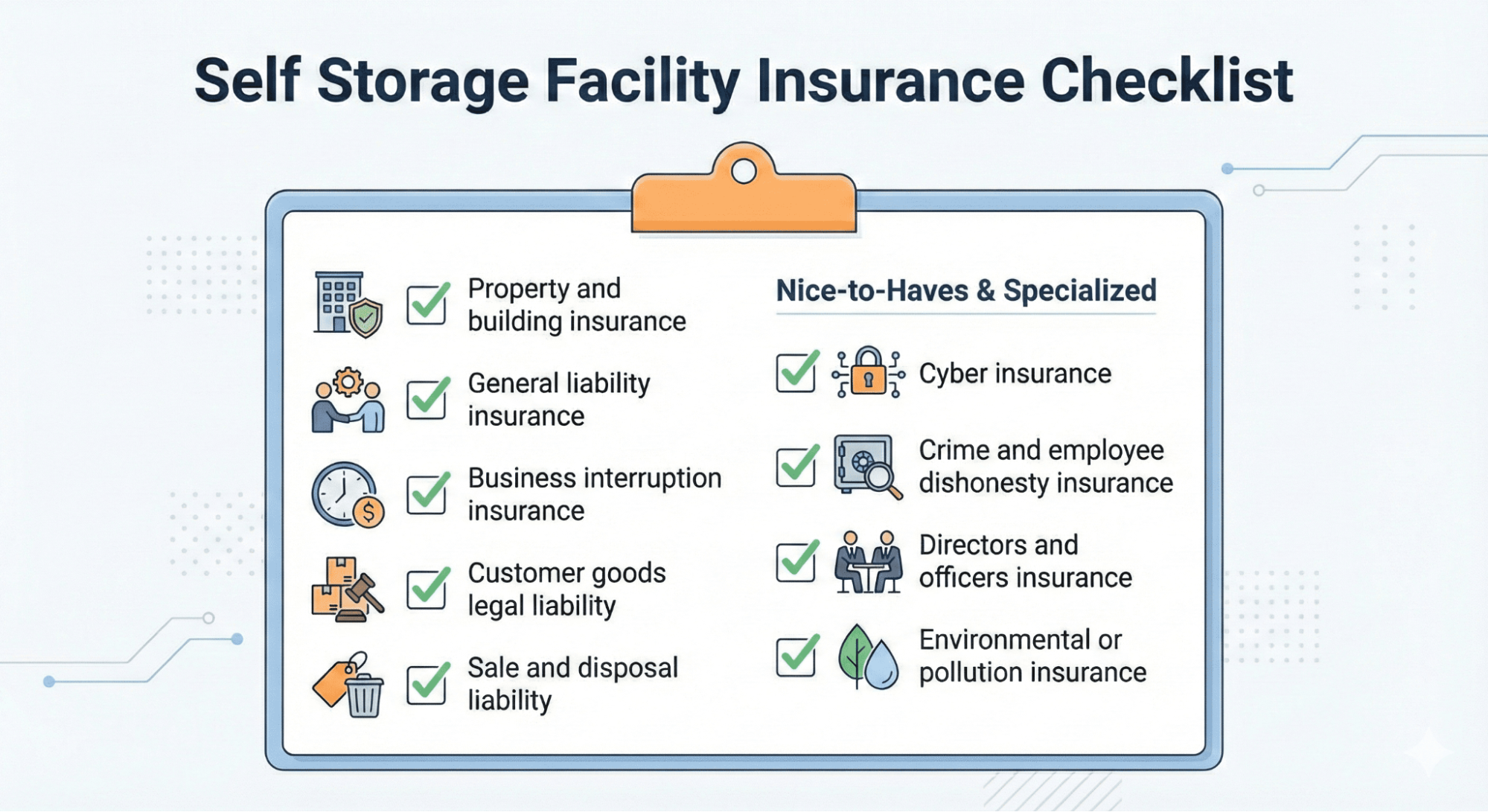

Insurance Every Self Storage Operator Needs

As previously discussed, your insurance should protect the facility, the business, and your exposure to claims.

While policies vary by provider and location, most facilities rely on the same core types of cover.

They include:

Property and building insurance

Property insurance covers the physical assets you own and operate, including storage buildings, offices, gates, fencing, lighting, and signage.

It is designed to respond to damage caused by events such as fire, storms, vandalism, or certain types of water damage.

Flooding, earthquakes, and other location-specific risks are often excluded or capped and may require separate policies.

General liability insurance

General liability insurance protects you if someone is injured on your premises or if your operations cause damage to third-party property.

For facilities with regular customer access, vehicle movement, and shared areas, this cover is essential. It typically pays for legal defense costs as well as settlements or judgments, making it a foundational policy for any storage operation.

Business interruption insurance

Business interruption insurance replaces lost income if a covered event forces your facility to close temporarily.

This matters because many storage businesses have fixed costs that continue even when units cannot be rented, such as loan repayments, utilities, staffing, and security. Without this coverage, even a short closure can have a disproportionate financial impact.

Customer goods legal liability

As previously mentioned, operators do not insure tenants' belongings; however, claims can arise if a tenant alleges that damage occurred due to the operator's negligence.

Customer goods legal liability provides protection only when the operator is found at fault, such as for losses linked to unresolved maintenance issues or operational failures.

Sale and disposal liability

When enforcing non-payment, operators must follow specific legal procedures to restrict access, auction units, or dispose of stored goods.

Sale and disposal liability insurance protects operators if a tenant challenges how the process was carried out, for example, due to notice errors or timing issues. It is intended to cover procedural mistakes, not deliberate or unlawful actions.

Optional but Valuable Insurance for Operators

As a self storage facility grows, other types of insurance may become more relevant.

These are not necessarily required, but they can help manage risks that emerge as facilities scale, systems become more digital, and teams expand.

- Cyber insurance: This is increasingly important for operators that rely on online bookings, digital payments, and customer accounts. As more of the rental process moves online, this cover can help address losses linked to data breaches, ransomware, or system disruptions.

- Crime and employee dishonesty insurance: This protects against financial loss resulting from employee or third-party theft or fraud. This risk tends to increase as staffing levels grow and responsibilities are spread across multiple roles.

- Directors and officers insurance: This is most relevant for operators with multiple sites, external investors, or formal management structures. It helps protect individuals involved in decision-making if claims are brought against them personally in connection with how the business is run.

- Environmental or pollution: This cover may be appropriate where stored items could pose a risk of leakage, fumes, or contamination. While most facilities prohibit hazardous materials, this insurance can provide additional protection if those rules are breached.

These policies help address risks that extend beyond the physical facility and become more prominent as operations become larger and more complex.

What Insurance Tenants Should Have

Tenant insurance is one of the most common sources of confusion in self storage. Many tenants assume their belongings are automatically protected once they move into a unit, while others overestimate how much cover their existing insurance provides.

Helping tenants understand their options upfront reduces disputes and sets clear expectations.

Homeowners and renters insurance (off-premises coverage)

Most homeowners and renters insurance policies include off-premises personal property coverage, which can apply to items stored in a self storage unit.

This typically covers common perils such as fire, theft, vandalism, and certain types of water damage.

The key issue is limits. Off-premises coverage is usually capped at a much lower level than in-home coverage, often as a percentage of the policy’s overall personal property limit.

As a result, tenants may technically have coverage but still be significantly underinsured for the value of goods stored in a unit.

Coverage terms and exclusions vary widely by insurer, so tenants should not assume full protection without checking their policy.

Common gaps tenants don’t realise they have

Even when off-premises coverage applies, several gaps regularly cause problems:

- Low off-premises caps: The maximum payout for stored items may be far lower than the total value of goods in the unit.

- High-value items: Items such as artwork, jewelry, collectibles, or specialist equipment often exceed standard limits unless specifically scheduled.

- Business inventory exclusions: Goods stored for business use are frequently excluded or restricted under personal homeowners or renters policies.

These gaps usually come to light only after a loss, when tenants discover their insurance coverage isn’t what they expected.

Self storage insurance and protection plans

Self storage insurance or protection plans offered by facilities are designed to address these limitations.

They typically provide defined coverage for stored goods against specified perils and are structured to complement, rather than replace, traditional insurance.

- For tenants, facility-offered insurance provides a straightforward way to secure appropriate cover without navigating policy exclusions or caps.

- For operators, it ensures tenants have protection in place and reduces uncertainty around responsibility when incidents occur.

This is why tenant insurance is widely used in the self storage industry: it creates clarity, improves protection for stored goods, and supports a smoother rental relationship from move-in onward.

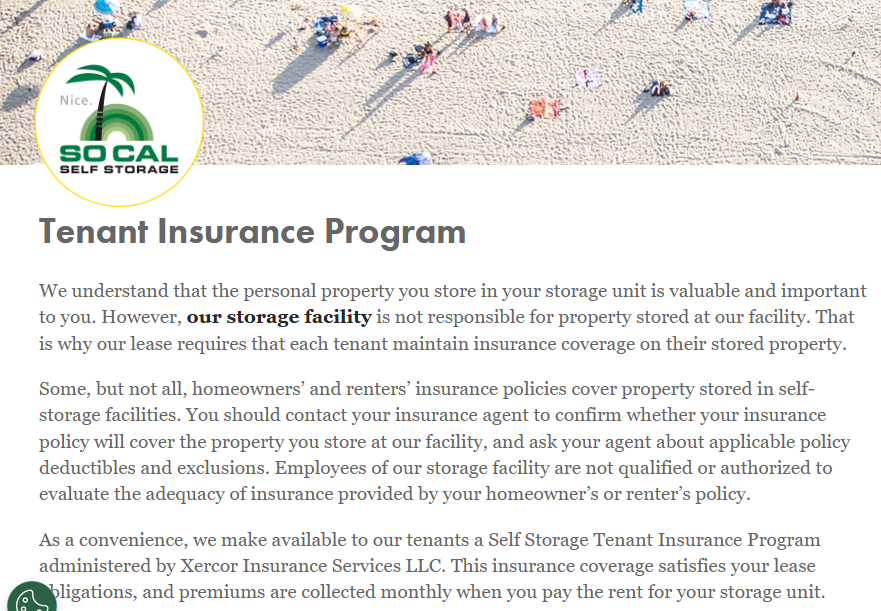

Here’s a good example of a self storage provider offering insurance to tenants. SoCal Self Storage requires all customers to insure their stored goods and provides coverage through a third-party insurance specialist.

Some larger self storage businesses have even launched their own specialist businesses providing coverage to tenants.

A good example of this is Savvy Storage Insurance Program, which was launched by Public Storage in 2023.

Should you require tenants to have insurance?

Many self storage operators require tenants to have insurance because it simplifies responsibility when something goes wrong.

If a tenant is insured, claims are handled through an insurer rather than becoming a dispute with the facility.

This helps to:

- Reduce friction

- Limit the operator’s involvement after a loss

- Establish clear boundaries around responsibility

- Ensure tenants have a practical way to recover the value of their belongings

Making insurance a condition of the lease also avoids the misconception that customer belongings are automatically insured.

Facilities typically enforce this requirement in one of two ways:

- Proof of third-party coverage, such as homeowners or renters insurance with off-premises protection.

- Facility-provided insurance or a protection plan, offered as a simple alternative at move-in.

Both approaches achieve the same outcome: fewer uninsured tenants and fewer problems when losses occur.

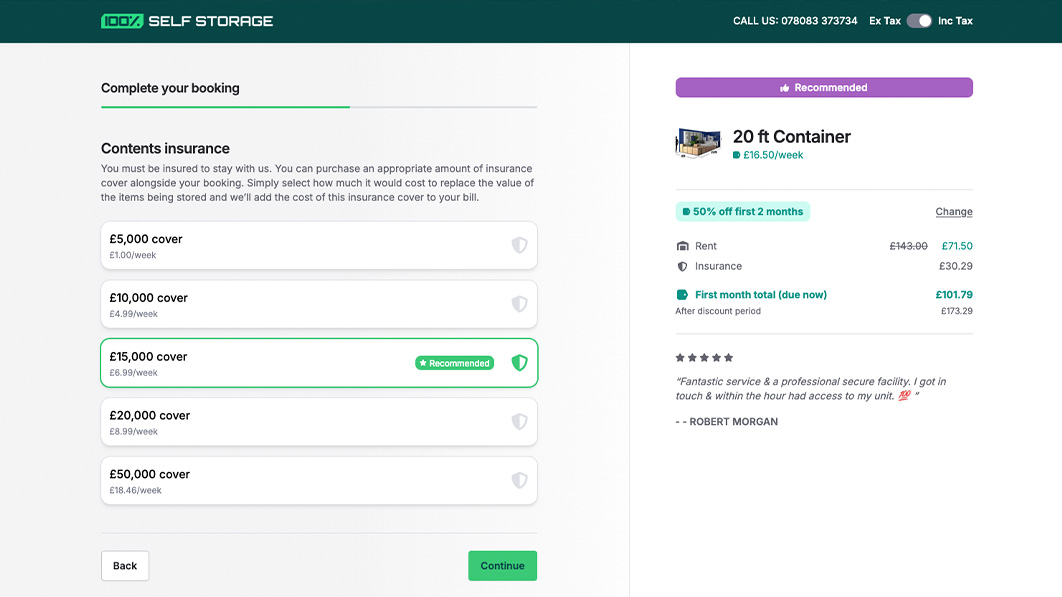

Selling Tenant Insurance Without Adding Operational Complexity

Tenant insurance works best when it is handled at move-in. This is when tenants are already reviewing terms, making decisions, and committing to the rental.

Introducing insurance after access has been granted often leads to delays, confusion, or non-compliance.

The problem with manual insurance tracking

Relying on manual processes to ensure your tenants have insurance creates several issues:

- Administrative overhead: Staff must request proof, chase documents, and track lapses.

- Inconsistent enforcement: Requirements vary by site, shift, or team member.

- Missed revenue: Insurance is offered irregularly or not at all.

Over time, this results in uninsured tenants and unnecessary operational friction.

Offering insurance as part of your digital booking process reduces these administrative issues and makes it quick and easy for customers to protect their property and comply with your rules.

How Stora’s Advanced Checkout helps you sell tenant insurance

Checkout is the most effective moment to address tenant insurance. By this stage, tenants have selected a unit, reviewed pricing, and are ready to complete their booking.

That’s where Stora can help. It’s a self storage management platform that helps operators manage online bookings, payments, and day-to-day facility operations from a single system.

Stora provides an Advanced Checkout that can be used to sell insurance to tenants at this critical stage:

- Tenant insurance can be offered directly during online booking

- Coverage is selected as part of the move-in flow

- Tenants can explicitly confirm their insurance choice before completing the booking

For operators, this means higher policy adoption, less manual admin, and a consistent stream of additional revenue.

Stora’s capabilities don’t end there. It also covers pricing, payments, access management, and day-to-day operational workflows for self storage facilities.

Find out how Stora can help your facility grow revenue and become more efficient. Sign up for a demo today.